#Lithium

Report: Lithium Americas Breaks Ground in Nevada Mining Operation

Lithium Americas has broken ground on its Thacker Pass mining operations, potentially opening the door to what some are calling the largest lithium deposit in the entire world. However, it’s estimated to be another three years before refinement takes place and the materials can be adapted for use in battery powered products — including all-electric vehicles.

EV Sales Are Up, But So Are Lithium Prices

With electric vehicle sales on the rise and the Biden administration allocating $900 million to address the insufficient charging infrastructure – one of the biggest obstacles EVs have to contend with – it seems like alternative energy automobiles may indeed become the future of driving. However, there is one problem even a firehose of money and mounting regulatory pressure can’t address.

Despite massive investments from both government and private entities, EVs need batteries, and the raw materials required aren’t getting any easier to obtain. Lithium values continue to rise and have recently reached an all-time high that’s setting the stage for pricier electric vehicles. While this wouldn’t be so bad by itself, EV prices jumped dramatically this year and have continued to do so at a pace that has overshadowed their combustion-reliant counterparts.

German Automakers Look to South America for Keystone Lithium Supply

With Europe increasingly fixated on regulating vehicular emissions, German automakers are throwing themselves into electrification like ’90s moms did with Beanie Babies. As with those moms, the investment has yet to pay off. Still, that hasn’t encouraged anyone to change course. Every player understood from the outset that transitioning to EVs was bound to be costly and, with increasingly stringent regulations proposed every month, there aren’t many alternatives.

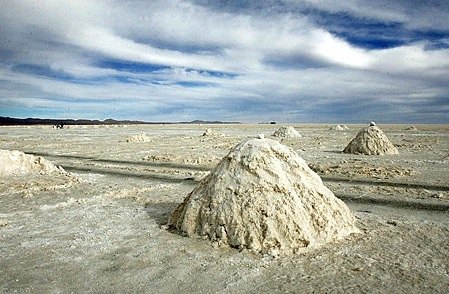

Volkswagen placed its very existence on electrification after Dieselgate, quickly running into problems with battery suppliers. And while VW claims it’s solved the issue for the next few years, it isn’t out of the woods yet. VW and Daimler have reportedly commissioned a study into sustainable lithium mining in Chile, but it’s already receiving pushback from environmental groups concerned about the delicate nature of the region’s Atacama salt flat — where the metal is found in abundance.

Suppliers Have More Lithium Than EV Manufacturers Currently Need

The lithium industry — essential for the production of battery electric vehicles — has run into a problem. It’s currently amassing more of the metal than it needs. Despite automakers like Tesla suggesting there will be upcoming global shortages of metals like copper, nickel, and lithium, the only element that battery suppliers appear to be truly desperate for is cobalt, which is largely the fault of where and how it’s mined ( the Congo, often by children).

Demand for the brittle, bluish metal skyrocketed this year, but not lithium. The latter metal’s global supply currently exceeds demand by about 5 percent, according to data from Canaccord Genuity.

Review: 2014 Chevrolet Spark EV (With Video)

Outside North America, this little blue pill of an A-segment car is known as the Daewoo Matiz Creative. It may look an obsolete computer peripheral (or a pregnant roller skate), but GM claims that the Chevrolet Spark has more torque than a Ferrari 458 Italia. As a self-described technology lover, and card-carrying resident of the Left Coast, I had to check it out.

Review: 2012 Infiniti M35h Hybrid

Let’s face it, hybrids are boring. They are slow, complicated, come with hard tires and soft suspensions, sloppy handling, and they look weird. We’ve heard the story before: this hybrid is different. First Lexus gave us the GS and RX hybrids claiming V8 performance with V6 fuel economy, but the result was more like V6 performance with V6 economy, not really a great sales pitch. Still, hybrids sell well and with Infiniti marching towards mainstream luxury success they “need” a hybrid. Of course, with Infiniti aiming to be the “Japanese BMW”, performance is obviously a prime concern, so the claim from Infiniti that the M35h will deliver “V8 performance and four-cylinder economy” was expected. But is it another case of leather clad disappointment? Let’s find out.

Swiss Environmental Study Finds EV Battery Production Impacts Outweighed By Operation Impacts

What about battery production? It’s one of the most popular criticisms of the green halo surrounding battery-electric vehicles, and one that’s widely circulated in anti-EV circles. Battery production, it is argued, requires the mining, transportation and processing of minerals which puts EVs at an environmental disadvantage compared to ICE vehicles. Needless to say, quantifying the impacts of ICE and electric drivetrain production is extremely difficult, due to the complexity and global supply chains required to produce both (not to mention the inherent difficulty of quantifying environmental impacts). But a study by the Swiss Federal Laboratories for Materials Science and Technology [via Green Car Congress] took on just that question, and indicates that

the impact of a Li-ion battery used in BEVs for transport service is relatively small. In contrast, it is the operation phase that remains the dominant contributor to the environmental burden caused by transport service as long as the electricity for the BEV is not produced by renewable hydropower.

Peak Lithium? Fohgeddaboutit

Some folks are convinced that EVs are taking over the world. So convinced they are that they are already publicly worried about peak Lithium. Lithium is found in unstable places. An internal Pentagon memo states that Afghanistan could become the “Saudi Arabia of lithium,” writes the New York Times. Then there are distressing news that countries like Chile, Bolivia and China sit on piles of lithium. Should we be worried? Nein, says a study from Germany.

And Now: Peak Lithium

If you want to play the commodities, forget pork bellies, soybeans or gold. Get into lithium. Not to treat the bipolar disorder exposure to the commodities market could trigger. Lithium to power cars. The Japanese Ministry of Economy, Trade and Industry figures that global lithium demand will more than triple from about 92,000 tons in 2010 to 310,000 tons in 2020. Who’s gobbling up the stuff? The automobile industry is expected to use 60 percent of the global lithium supply in 2020, up from less than 5 percent this year. No wonder there is a run on the material.

Toyota Takes Their Lithium

After years of spurning lithium ion batteries in favor of Nickel metal hydride cells, it seems Toyota might changing their mind. The Wall Street Journa l reports that Toyota Tsusho Corp, which is 21.8% owned by Toyota Motor Corp., has secured the loans it needed from the Japanese government to buy a stake in a lithium project in Northern Argentina. The article states that “people with knowledge of the matter” (read in to that what you will), values Toyota Tsusho’s investment somewhere between $100 million and $200 million.

Recent Comments