Tesla IPO Priced At $17/Share, Market Cap Estimated At $1.6b

A source tells Reuters [UPDATE: Tesla confirms in press release] that Tesla has

sold 13.3 million shares for $17 each, raising about $226 million. It raised the number of shares it hoped to sell by 20 percent. It had planned to sell 11.1 million shares for $14 to $16 each.

That’s more than the “as much as $213m” number floated earlier, but with a recent Toyota deal and an EV-infrastructure bill in congress, Tesla has as much wind at its back as it can ask for. But if investors do get to start trading Tesla stock starting tomorrow, they’ll have a gut check before long. Tesla lost $30m last quarter, and it the second quarter ends on Wednesday. If those numbers show another healthy loss, investors will look away knowing that they’re in a risky, long-term investment. But can a $1.6b market-cap firm really compete in development, design and manufacturing with the giants of the automotive world simply by taking in two times its 2009 revenue in one IPO?

On that point, Bloomberg BusinessWeek has an interesting insight:

At the midpoint price of $15, Tesla is valued at 5.5 times its net tangible assets, a measure of shareholder equity that excludes assets that can’t be sold in liquidation. That’s triple the median 1.82 times for automotive companies globally, data compiled by Bloomberg show.

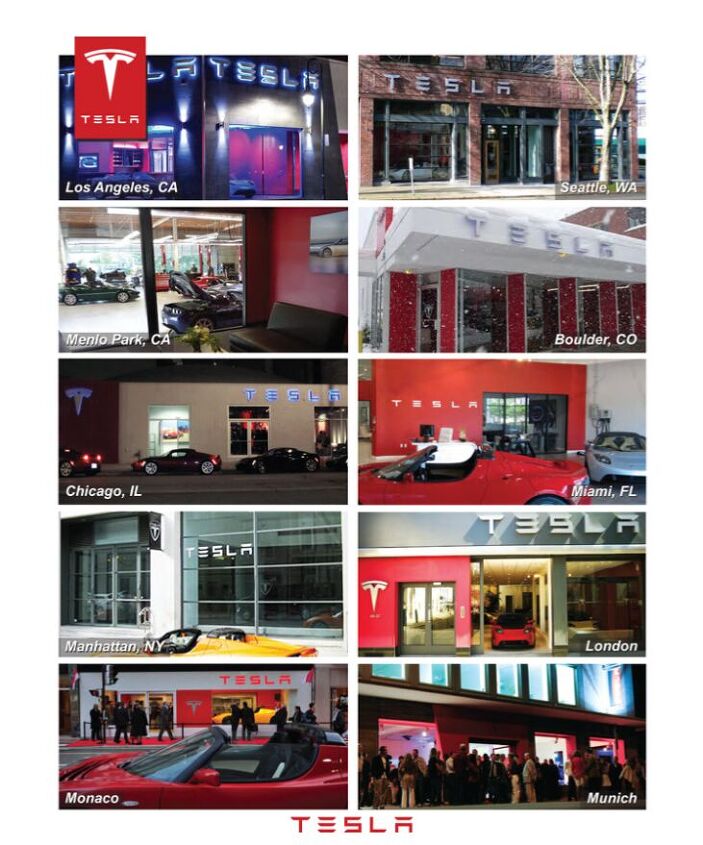

Which means Tesla is even more overleveraged at $17/share. And Tesla’s own prospectus mentions the challenges the firm faces at its projected volumes, especially on the retail front. Unless Tesla figures out how to get state-by-state franchise laws to allow internet car sales, much more money will need to be raised. Meanwhile, the Model S has yet to be spotted publicly road testing. And the Roadster is being canceled.

At the same time, Tesla’s sheer audacity deserves at least a little respect. It’s a wild moonshot of a company that resonates with lots of Americans for a number of reasons. The West coast of the United States doesn’t have many home-grown automotive protagonists. Tesla has probably benefited to some extent from anti-petroleum sentiment stirred up by the Gulf of Mexico oil spill. Still, Tesla needs to run on more than feel-good momentum and boutique service. They need to sell cars.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 3SpeedAutomatic I just road in a rental Malibu this past week. Interior was a bit plasticity, but, well built.Only issue was how “low” the seat was in relation to the ground. I had to crawl “down” into the seat. Also, windscreen was at 65 degree angle which invited multiple reflections. Just to hack off the EPA, how about a boxy design like Hyundai is doing with some of its SUVs. 🚙 Raise the seat one or two inches and raise the roof line accordingly. Would be a hit with the Uber and Lyft crowd as well as some taxi service.🚗 🚗🚗

- Dartdude Having the queen of nothing as the head of Dodge is a recipe for disaster. She hasn't done anything with Chrysler for 4 years, May as well fold up Chrysler and Dodge.

- Pau65792686 I think there is a need for more sedans. Some people would rather drive a car over SUV’s or CUV’s. If Honda and Toyota can do it why not American brands. We need more affordable sedans.

- Tassos Obsolete relic is NOT a used car.It might have attracted some buyers in ITS DAY, 1985, 40 years ago, but NOT today, unless you are a damned fool.

- Stan Reither Jr. Part throttle efficiency was mentioned earlier in a postThis type of reciprocating engine opens the door to achieve(slightly) variable stroke which would provide variable mechanical compression ratio adjustments for high vacuum (light load) or boost(power) conditions IMO

Comments

Join the conversation

"overleveraged "? In what version of the English language? Capital raised via shares typically reduces leverage.

Tesla is a scam and a racket that deserves condemnation, beyond maybe riding whatever enthusiasm is out there and dumping before it all comes crashing down. car insurance quote