Honda Solidifies Its Existing Businesses

Honda Motor Company President Toshihiro Mibe’s first press conference, held April 23rd, was where he committed to solidifying Honda’s existing businesses.

Honda is working to achieve carbon neutrality for all products and activities by 2050. Zero environmental impact not only for its products but their entire lifecycle. Areas of concentration include carbon neutrality, clean energy, and resource circulation.

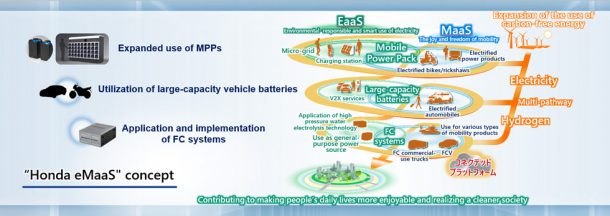

Honda’s power pack swappable batteries will expand electrified cars’ and motorcycles’ range. Infrastructure-linked smart power operations encourage renewable energy use.

Mibe said Honda will be hydrogen-proactive, among a variety of energy sources. Carbon-neutral fuels are part of an energy multi-pathway.

Honda continues the eMaaS concept, where the company supports mobility freedom and renewable energy use expansion. This includes the use of mobile power packs, large-capacity batteries in EVs, and fuel cell systems growth.

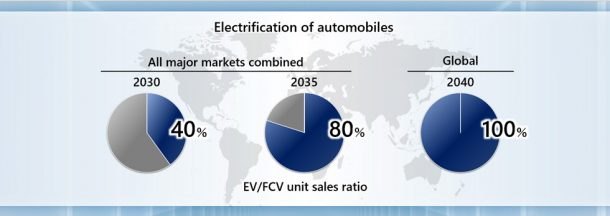

Honda’s battery-electric vehicle (EVs) and fuel cell electric vehicle (FCVs) ratio in all major EV markets will be 40 percent by 2030, 80 percent by 2035, and 100 percent by 2040. Meeting these targets will require the entire chain’s participation. Honda set high goals to clarify what they want to accomplish. Honda employees worldwide accept the challenge of trying to reach these goals.

The North American target EV/FCV sales ratio is 40 percent by 2030, 80 percent by 2035, and 100 percent by 2040. Leveraging the General Motors alliance, Honda will pursue electrification by taking advantage of the strengths of both companies. Honda and GM are developing two large-sized EV models using GM’s Ultium batteries. They are planning to introduce these vehicles as 2024 models, one from Honda and the other from Acura.

Honda will launch a series of new EV models using e:Architecture, a new EV platform led by Honda. These EV models will be introduced in North America, and then in other parts of the world.

In China, Honda’s EV/FCV unit sales targets are identical to that of North America. Honda has introduced EV models using local resources, and will further accelerate this approach going forward. Strengthening their collaboration with CATL for batteries is one example. 10 Honda-brand EV models will be introduced in five years. The first of these models based on the Honda SUV e:prototype, will go on sale in spring 2022.

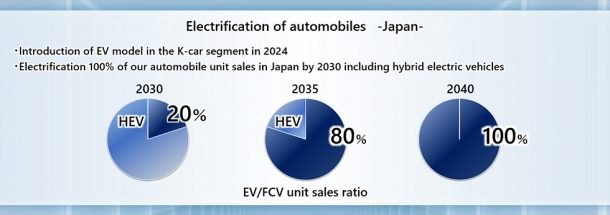

In Japan, Honda’s EV/FCV unit sales target starts out at a modest 20 percent by 2030, then catches up with the rest of the world in 2035. They expect 100 percent of their automobile unit sales in Japan by 2030 to be electric. The first to debut K-car segment EV in 2024, Honda is progressing in the electrification of both hybrid and EV K-cars.

A local production and local procurement approach to sourcing batteries in Japan, this will also contribute to growth domestically. Addressing mobility services (MaaS), Honda is working on the Cruise Origin, an electric self-driving vehicle they are developing with GM.

Maintaining EV competitiveness has meant all-solid-state battery research as the next-gen high-capacity, low-cost power source. Production technology verification will start this year. Honda is accelerating this research to make all-solid-state batteries available in the second half of the 2020s.

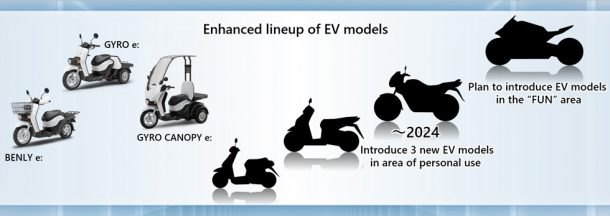

Honda’s motorcycle industry leadership includes not only electrification but also improving gasoline engine fuel efficiency, biofuel utilization, and other strategies. Electrification of motorcycles required consideration of batteries separately from the motorcycle. In developed countries, Honda will pursue electrification utilizing their mobile power packs, targeting B-to-B (business-to-business) and B-to-G (business-to-government) customers.

For personal use, Honda is enhancing their product lineup. They will make battery-swapping stations available, and ensure user convenience by making them swappable with other makes. Honda has established a consortium with other Japanese and European motorcycle OEMs to develop technology standards for swappable batteries. Expanding mobile power pack applications beyond motorcycles to power products and micro-mobility products is another of Honda’s goals.

Introducing GYRO e: and GYRO CANOPY e: business-use bikes this year, Honda will also have three new personal use EVs with engine sizes below 50cc and below 125cc by 2024.

Hydrogen is expected to be a popular renewable energy source. While continuing to collaborate with GM, Honda wants to reduce costs and start a hydrogen base by FCV lineup expansion. They also want to use FC systems for a wide range of applications, including commercial trucks, stationary, and movable power sources.

Striving for zero traffic collision fatalities involving Honda products globally by 2050, the major challenge is how to eliminate motorcycle collision fatalities, especially in emerging countries. Strengthening research on safety technologies that enable motorcycles and automobiles to safely coexist will lead the way towards a collision-free society.

Motorcycle collision fatalities often involve automobiles. Honda’s application of its omnidirectional ADAS (advanced driver-assistance system) to all new automobiles they introduce in developed countries by 2030 will help reduce that number. Using their Level 3 automated driving technologies, it will further enhance ADAS intelligence, which increases the percentage of collision patterns covered.

Regardless of sales revenue fluctuations, Honda will invest a total of $5 trillion Yen ($45,999,250,000 U.S.) in research and development over the next six years. The company will take the necessary measures, including alliances, to further develop digital technologies as quickly as possible. They will also be proactive in building a strong electrification value chain.

Ambitious? Not for a motorcycle company that came ashore in the U.S. in 1959.

[Images: Honda]

With a father who owned a dealership, I literally grew up in the business. After college, I worked for GM, Nissan and Mazda, writing articles for automotive enthusiast magazines as a side gig. I discovered you could make a living selling ad space at Four Wheeler magazine, before I moved on to selling TV for the National Hot Rod Association. After that, I started Roadhouse, a marketing, advertising and PR firm dedicated to the automotive, outdoor/apparel, and entertainment industries. Through the years, I continued writing, shooting, and editing. It keep things interesting.

More by Jason R. Sakurai

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- B-BodyBuick84 Not afraid of AV's as I highly doubt they will ever be %100 viable for our roads. Stop-and-go downtown city or rush hour highway traffic? I can see that, but otherwise there's simply too many variables. Bad weather conditions, faded road lines or markings, reflective surfaces with glare, etc. There's also the issue of cultural norms. About a decade ago there was actually an online test called 'The Morality Machine' one could do online where you were in control of an AV and choose what action to take when a crash was inevitable. I think something like 2.5 million people across the world participated? For example, do you hit and most likely kill the elderly couple strolling across the crosswalk or crash the vehicle into a cement barrier and almost certainly cause the death of the vehicle occupants? What if it's a parent and child? In N. America 98% of people choose to hit the elderly couple and save themselves while in Asia, the exact opposite happened where 98% choose to hit the parent and child. Why? Cultural differences. Asia puts a lot of emphasis on respecting their elderly while N. America has a culture of 'save/ protect the children'. Are these AV's going to respect that culture? Is a VW Jetta or Buick Envision AV going to have different programming depending on whether it's sold in Canada or Taiwan? how's that going to effect legislation and legal battles when a crash inevitibly does happen? These are the true barriers to mass AV adoption, and in the 10 years since that test came out, there has been zero answers or progress on this matter. So no, I'm not afraid of AV's simply because with the exception of a few specific situations, most avenues are going to prove to be a dead-end for automakers.

- Mike Bradley Autonomous cars were developed in Silicon Valley. For new products there, the standard business plan is to put a barely-functioning product on the market right away and wait for the early-adopter customers to find the flaws. That's exactly what's happened. Detroit's plan is pretty much the opposite, but Detroit isn't developing this product. That's why dealers, for instance, haven't been trained in the cars.

- Dartman https://apnews.com/article/artificial-intelligence-fighter-jets-air-force-6a1100c96a73ca9b7f41cbd6a2753fdaAutonomous/Ai is here now. The question is implementation and acceptance.

- FreedMike If Dodge were smart - and I don't think they are - they'd spend their money refreshing and reworking the Durango (which I think is entering model year 3,221), versus going down the same "stuff 'em full of motor and give 'em cool new paint options" path. That's the approach they used with the Charger and Challenger, and both those models are dead. The Durango is still a strong product in a strong market; why not keep it fresher?

- Bill Wade I was driving a new Subaru a few weeks ago on I-10 near Tucson and it suddenly decided to slam on the brakes from a tumbleweed blowing across the highway. I just about had a heart attack while it nearly threw my mom through the windshield and dumped our grocery bags all over the place. It seems like a bad idea to me, the tech isn't ready.

Comments

Join the conversation

Quote- Striving for zero traffic collision fatalities involving Honda products globally by 2050. They can strive and dance and talk all they want but this is an impossibility with so many factors at work- road irregularities, cost cutting, software and sensor glitches, weather etc to name a few. Instead they should be aiming at a reduction which is far more realistic.

"Ambitious? Not for a motorcycle company that came ashore in the U.S. in 1959." Yes it is - it's ambitious PR drivel. For starters, swappable batteries is a failed idea. FCVs are energy upside down, and hydrogen is going nowhere unless some brave company gives a Tesla-like effort to make it viable, including the mfr and distribution of the fuel. And even Tesla doesn't have to produce and distribute the power for their Superchargers.