U.S. Auto Sales, September 2018: An Athletic Fiat Chrysler Leapfrogs Ford

Dealerships across America were awash in red last month, both from the ink spilling across financial ledgers and the anger emitting from corner offices. Just about every marque was off in September and not by insignificant amounts. This can be blamed on a number of factors, not the least of which was last year’s pent up demand after a devastating Hurricane Harvey and this year’s Hurricane Florence having the opposite effect.

One ray of sunshine? Fiat Chrysler, which finally got its Ram production in gear and started delivering snazzy new pickup to eager customers in a big way. Of course, having the perpetually strong-selling Jeep brand on the books didn’t hurt, either.

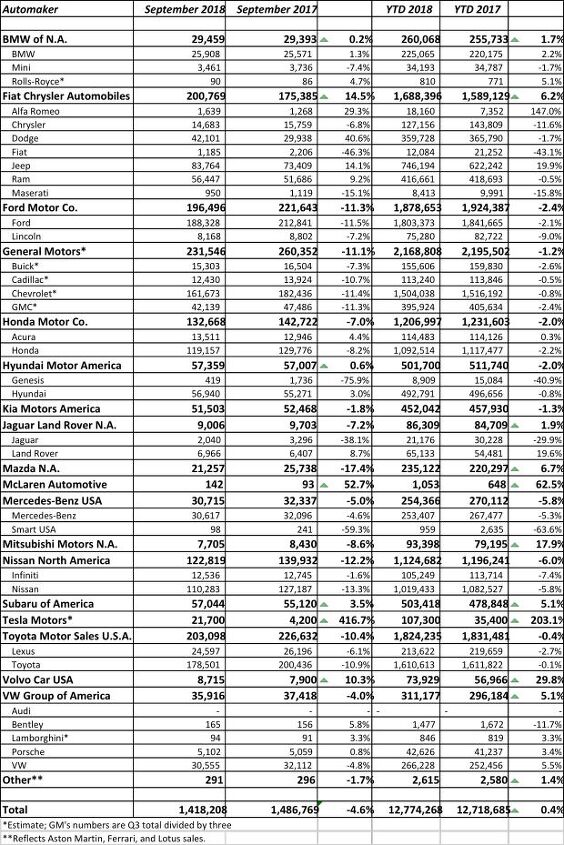

A close look at the numbers in this chart reveal a stat the market hasn’t seen since 2015: the whole of FCA outsold the whole of Ford, this time by about 4,000 units. FCA was fuelled by a 14 percent jump at Jeep and a 9 percent leap at Ram. While those two numbers are but snapshots in time, it is worth pointing out that sales for three quarters of this year — a much larger sample size and a better yardstick with which to measure success — sees Jeep jump an astonishing 19.9 percent to 746,194 units. That’s fewer than 200,000 machines than the rest of the company combined.

At General Motors, which sees fit to grace us with actual numbers only on a quarterly basis, dealers delivered 694,638 vehicles in the third quarter of 2018. Down slightly (1.2 percent) when compared to the same time last year, the company boasted of average transaction prices rising about $700 per unit, year over year, to a new third quarter corporate record of $35,974.

September sales at The General did decline 11 percent, year over year, with the impact of hurricanes sharply increasing both industry and GM sales this time in 2017 and depressing them somewhat this year. Note: GM’s fleet deliveries, up 5 percent year over year, were about 21 percent of total sales during the quarter.

Year to date at the Blue Oval, cars are off an unsurprising 17.4 percent, which is what happens when a company announces the death of all of its product except the Mustang. Wide swaths of customers tend to avoid vehicles whose date is already carved on a tombstone. The gain in trucks and SUVs, 1.1 and 3.2 percent respectively, is so far not enough to make up for the Glass House’s flatlining car division.

Trucks trucks trucks narrative aside, Honda pointed out that its electrified offerings — comprised of the Accord Hybrid, Insight, and Clarity Plug-in Hybrid — combined for nearly 6,000 September deliveries. Honda noted fuel prices topping $4.00/gal in some parts of the country, an observation standing in stark contrast to the strong performance of trucks.

If one needs any further proof of the value of trucks and SUVs (we’re pretty sure no one does, but this month’s numbers makes the point abundantly clear) check out the September results for Genesis and Subaru. One is laden with crossovers and all-wheel drive units. The other isn’t.

The third quarter light vehicle SAAR was 17.2 million units in 2017 and 16.9 million in 2018. If the market does indeed crest 17 million units this year, it’ll be due to an unexpected late-year surge.

Anyone in your cadre of pals pull the trigger on a new machine last month? Chime in below.

Matthew buys, sells, fixes, & races cars. As a human index of auto & auction knowledge, he is fond of making money and offering loud opinions.

More by Matthew Guy

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Steve Biro There are 24 races on this year’s F1 schedule. And I guarantee you no more than two will be reasonably exciting, Meanwhile, F1’s reception for Andretti reveals the dark underbelly of the sport. I have followed F1 since the 1960s and, frankly, I am running out of interest. I’ll catch a race if it’s convenient but won’t bother DVRing them.

- YellowDuck Been watching since the 80s, seriously since the 90s once we had reliable TV coverage. I'm in Canada though. Hey, and don't forget that the Interlagos race is also in a convenient time zone, as is Mexico. So that's 5 races in the Americas. Absolutely love it, but it takes a bit more interest in the technical / strategic side of things to really appreciate it. It's not just going fast in circles until someone crashes into someone else, while drunk people watch. The US can be proud of what it has contributed - Austin is one of the best tracks on the calendar, Vegas turned out to be much better than anyone could have hoped, and even Miami - a real Indy car-style track - produced a good race this year.

- JMII I watch every F1 race, same with Indycar which is 100X better in terms of actual racing.

- Dale Quelle surprise.

- 3SpeedAutomatic Nice looking, but IIRC, there was an issue with these engines where a knock would develop. That may account for the very low milage. 🚗🚗🚗

Comments

Join the conversation

Why place the blame on Hackett when he inherited the problem from his predecessor? Do you really believe a new CEO can fix an ailing system in just a few months when it typically takes YEARS to revamp a product line like cars?

Ford tried the tech/Internet future approach with Jac Nasser. Then came the burst tech bubble, clashes with Billy Ford, the Explorer/Firestone fiasco and falling profits. Nasser got canned, Billy took over for 4 years and things got even worse. I really do think of the Ford Family as charter members of the Lucky Sperm Club. They chase after every bright shiny object and never learn.