Nissan Prepares For The Worst In China

All three major Japanese automakers have reported their half year financial results. After Honda last week and Toyota yesterday, Japan’s number two automaker Nissan followed today. The presentations could not have been more different.

After the world had seen Japanese cars upended and dealerships torched in China, and after Honda had cut its profit forecast for the fiscal year to March by more than a billion dollars due to a drastic drop in China sales, observers expected other Japanese majors to follow suit. Yesterday, Toyota did the opposite and upped its profit forecast for the current fiscal by a few billion yen. Today at Nissan in Yokohama, it was back to the brutal realities.

In the first half, Nissan delivered operating profit of 287 billion yen ($3.61 billion), and a net profit of 178.3 billion yen ($2.25 billion), 2.8 percent lower than in the same period of the previous year.

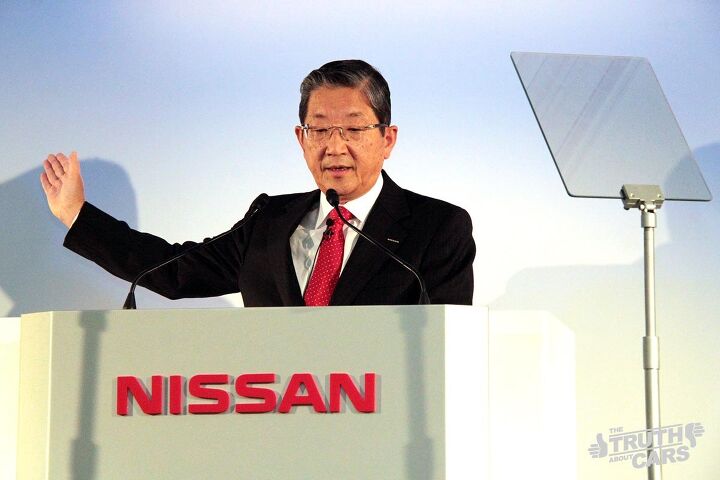

The full impact of the islands row hit after the books were closed. In its guidance for the full fiscal year that ends on March 31, 2013, Nissan expects a net income of 320 billion yen (US $4 billion). Like Honda, Nissan lopped a full billion off what Nissan COO Toshiyuki Shiga called a “very conservative, worst case scenario” forecast. Along with the financial forecast, Nissan also lowered its projected sales by 270,000 units to slightly over 5 million, 175,000 of those due to China.

Other than Toyota’s presentation, where China received a few passing mentions, Nissan’s conference was all about China. Shiga said the showroom traffic is picking up again and that orders are returning. He has “seen improvements to about 70 percent of normal.” 30 percent less than normal is seen as an improvement over past weeks, where showrooms were near empty.

Nissan’s formerly ambitious growth plans in China definitely have been stunted. Nissan had been running on an annualized clip of 1.17 million units for China, and had hopes for more. Now, Nissan is trying to maintain last year’s level of a little more than 800,000 units, Shiga says.

Why do the fallouts of the China row hit Nissan and Honda in the solar plexus , while eliciting little more than a la-di-da from Toyota? Of the three Japanese majors, Toyota has the smallest exposure to China, and where one does not have much, not much can be lost. On the other hand, one cannot shake the impression that Toyota is whistling a bit in the dark.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Dwford The problem with Cadillac is that the only Cadillac they sell is the Escalade. Cadillacs are supposed to be large imposing vehicles that are visually impressive. Only the Escalade meets that standard. Everything else Cadillac sells are knock off BMWs. Cadillac shouldn't be in the business of selling compact 4 cylinder crossovers. Dime a dozen vehicles. You'd be better off buying a high trim version of any mainstream crossover than an XT4. Why does a CT4 start at the same price as a Camry XSE? Why do Buicks have nicer interiors than Cadillacs? Why to CHEVYS have nicer interiors than Cadillacs?

- EBFlex “Insatiable demand” Pretty sad when even the Uber deranged EU doesn’t want EVs.

- Jbltg Had a rental like this once, stock of course. NYC to Vermont. Very smooth and quiet, amazing fuel economy. Not the best for interior space though. Back seat and trunk barely usable.

- MKizzy I suppose this means most GM rentals will be Trailblazers and/or Traxes with Encore GX's and Envistas considered an upgrade.GM stopped trying with the Malibu years ago and was merely waiting for its opportunity to swing the axe. Any U.S. sedan GM introduces in the future will probably come from China barring a trade war escalation. At least the plant producing the Malibu it won't close; at least not until GM finds a way to move production of the next Bolt across the border or offshore without touching the UAW third rail.

- OA5599 Yes, I will miss it because it is the demise of another sedan. We need people driving sedans instead of dangerous SUV's and unsafe monster-sized pickups. That is, dangerous and unsafe to pedestrians and those in sedans on the receiving end of being t-boned by SUV's and pickups.

Comments

Join the conversation

Does it have anything to do with Toyota treating the chinese sales as a separate company not wholly owned (equity method)? Maybe Toyota is doing one of the classic play of not answering the real question and instead giving a technically correct answer and forecast based on "all known information" for their operations.