Mazda's U.S. Sales Situation Finally Starts Coming Together, in the Middle of a Pandemic? And Because of the Miata?

Month after month, as the Mazda product lineup improves and as plaudits pour in, we chronicle the company’s tragic dearth of U.S. sales success. The automaker’s goals for performance in the American marketplace are modest: a good 2 percent market share, for example. Yet generating meaningful demand for deserving products – the second-generation CX-9 and the new-for-2019 Mazda 3, as examples – has proven remarkably challenging.

At least it was remarkably challenging, until a pandemic battered and bruised the U.S. auto market beyond all recognition. U.S. auto sales in the first quarter of 2020 tumbled by more than 12 percent, yet Mazda sales during the same period were off by just 4 percent. Mazda market share ticked up to 1.9 percent in Q1.

But it was Mazda’s May 2020 performance, in which the brand’s sales in the United States dropped by fewer than 300 units, that Mazda appeared downright hopeful. You won’t be surprised to learn the market fared much, much worse.

There’s a problem with May reporting, just as there was with April reporting, just as there will be with sales reports issued for July, August, October, and November. Most automakers now refrain from monthly reports, opting instead to issue model-specific U.S. sales stats only on a quarterly basis.

Mazda is joined only by nine other brands: Acura, Genesis, Honda, Hyundai, Kia, Lexus, Subaru, Toyota, and Volvo. Those nine brands collectively reported a 21-percent drop, 21 times worse than Mazda’s almost imperceptible decline. After an estimated 39-percent decline for the overall industry in March and a 50-percent nosedive in April, May sales likely dipped by around 30 percent based on estimates for non-reporting brands.

That would mean Mazda’s market share grew from 1.6 percent in May 2019 to 2.2 percent in May 2020.

How?

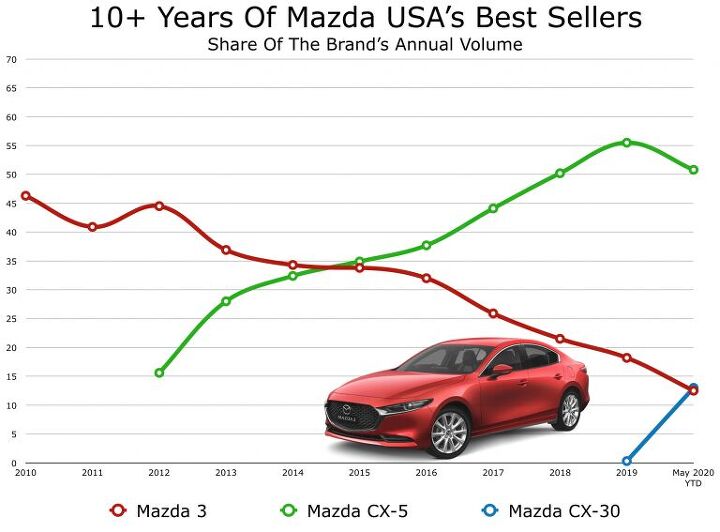

As predicted, the first ever, confusingly named, right-sized Mazda CX-30 is central to the brand’s mid-COVID improvements. Yet the addition of the CX-30’s 3,583 additional sales was by no means the only bonus for Mazda.

Year-over-year, MX-5 Miata sales jumped 31 percent. With 1,102 sales, it was the first four-digit sales month for Mazda’s droptop since last July and only the fifth such 1K+ month in the last three years. Mazda averaged fewer than 700 monthly Miata sales in 2019 and hasn’t averaged more than 1,000 per month since 2007.

Sales of Mazda’s flagship, the three-row CX-9, also shot up in May. 2,421 CX-9s were sold, a 21-percent YOY improvement. Through the first five months of the year, CX-9 sales are up 6 percent. That puts the second-gen CX-9, launched in 2016, on track for its best year yet.

Deserving of the bulk of credit, however, is the CX-30, a competitor for the Subaru Crosstrek, Nissan Rogue Sport, Kia Seltos, and numerous others, including vehicles in Mazda’s lineup. Consider the fact that while Mazda added 3,583 CX-30 sales in May, sales of the Mazda 3 (with which it shares a platform), CX-3 (which it’s destined to replace), and CX-5 (which it undercuts in price) dropped by a total of 3,862 units.

It would be too simplistic to suggest that every sale of a CX-30 cost Mazda the sale of a 3, CX-3, or CX-5. But it certainly wouldn’t be too far-fetched to suggest that the CX-30 acted in cannibalistic fashion in various corners of the Mazda showroom. The CX-30 is certainly cementing its position as the CX-5’s prime understudy: CX-30 sales have outnumbered sales of the 3 (sedan and hatch inclusive) since March.

Through the end of May, Mazda sales in 2020 are down 11 percent, a loss of more than 12,000 units. Kia, Hyundai, Toyota, Subaru, and Honda fell 13 percent, 17 percent, 21 percent, 23 percent, and 25 percent, respectively, during the same five-month period. Mazda’s market share picture will become much clearer when all automakers report first-half auto sales in early July.

[Images: Mazda]

Timothy Cain is a contributing analyst at The Truth About Cars and Driving.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Dartdude Having the queen of nothing as the head of Dodge is a recipe for disaster. She hasn't done anything with Chrysler for 4 years, May as well fold up Chrysler and Dodge.

- Pau65792686 I think there is a need for more sedans. Some people would rather drive a car over SUV’s or CUV’s. If Honda and Toyota can do it why not American brands. We need more affordable sedans.

- Tassos Obsolete relic is NOT a used car.It might have attracted some buyers in ITS DAY, 1985, 40 years ago, but NOT today, unless you are a damned fool.

- Stan Reither Jr. Part throttle efficiency was mentioned earlier in a postThis type of reciprocating engine opens the door to achieve(slightly) variable stroke which would provide variable mechanical compression ratio adjustments for high vacuum (light load) or boost(power) conditions IMO

- Joe65688619 Keep in mind some of these suppliers are not just supplying parts, but assembled components (easy example is transmissions). But there are far more, and the more they are electronically connected and integrated with rest of the platform the more complex to design, engineer, and manufacture. Most contract manufacturers don't make a lot of money in the design and engineering space because their customers to that. Commodity components can be sourced anywhere, but there are only a handful of contract manufacturers (usually diversified companies that build all kinds of stuff for other brands) can engineer and build the more complex components, especially with electronics. Every single new car I've purchased in the last few years has had some sort of electronic component issue: Infinti (battery drain caused by software bug and poorly grounded wires), Acura (radio hiss, pops, burps, dash and infotainment screens occasionally throw errors and the ignition must be killed to reboot them, voice nav, whether using the car's system or CarPlay can't seem to make up its mind as to which speakers to use and how loud, even using the same app on the same trip - I almost jumped in my seat once), GMC drivetrain EMF causing a whine in the speakers that even when "off" that phased with engine RPM), Nissan (didn't have issues until 120K miles, but occassionally blew fuses for interior components - likely not a manufacturing defect other than a short developed somewhere, but on a high-mileage car that was mechanically sound was too expensive to fix (a lot of trial and error and tracing connections = labor costs). What I suspect will happen is that only the largest commodity suppliers that can really leverage their supply chain will remain, and for the more complex components (think bumper assemblies or the electronics for them supporting all kinds of sensors) will likley consolidate to a handful of manufacturers who may eventually specialize in what they produce. This is part of the reason why seemingly minor crashes cost so much - an auto brand does nst have the parts on hand to replace an integrated sensor , nor the expertice as they never built them, but bought them). And their suppliers, in attempt to cut costs, build them in way that is cheap to manufacture (not necessarily poorly bulit) but difficult to replace without swapping entire assemblies or units).I've love to see an article on repair costs and how those are impacting insurance rates. You almost need gap insurance now because of how quickly cars depreciate yet remain expensive to fix (orders more to originally build, in some cases). No way I would buy a CyberTruck - don't want one, but if I did, this would stop me. And it's not just EVs.

Comments

Join the conversation

There is a Mazda that embodies the feeling a previous MX-5/RX driver would enjoy for the family. It's better than any SUV at handling, has a third row seat, and is good on gas. It's the 5. The only problem I had was some understeer which I remedied with a fatter rear stabilizer. Unfortunately, vans are not de rigeur and fashion is loyal to no one. That's ok because, as I'm ripping around corners while hauling everything else in between, let all the flashy sports car people get pulled over by cops while I zip by unnoticed.

All things considered, there aren't very many Mazda dealers around and that sure doesn't help the sales situation. It seems to me that where there are Mazda dealers, the cars seem to sell fairly well. I see a fair number of Mazda 3s, CX-9s, CX-5s and CX-3s, and a few 6s and MX-5s where I currently live. I haven't seen a CX-30 yet.