Midsize Sedan Deathwatch #15: Toyota Camry Proves to Be a Killer In August 2017

The launch of the all-new 2018 Toyota Camry began in July 2017 and delivered a big boost to America’s best-selling midsize car in August 2017.

As its competitors combined for a 12-percent loss valued at nearly 16,000 fewer sales than in August 2016, Toyota Camry sales jumped 13 percent, a gain of 4,187 sales. That figure includes 6,805 new-gen Camrys imported from Japan, where the Camry’s home market factory is being relied upon while Toyota’s Georgetown, Kentucky, assembly plant gathers steam for the entirely different Toyota New Global Architecture.

With falling sales across much of the category and rising volume at the top seller, Toyota got exactly what it called for in August 2017: a huge market share increase. But did the Camry provide the rumored boost to the segment overall? Quite clearly no, not yet.

This is the fifteenth edition of TTAC’s Midsize Sedan Deathwatch. The midsize sedan as we know it — “midsizedus sedanicus” in the original latin — isn’t going anywhere any time soon, but the ongoing sales contraction will result in a reduction of mainstream intermediate sedans in the U.S. market.

How do we know? It already has.

Granted, the Camry’s surge slowed the rate of the segment’s decline overall. Through 2017’s first seven months, midsize sedan sales in America had fallen 18 percent. Total midsize car sales were down just 7 percent in August, the slowest rate of year-over-year decline since November of last year.

The Camry’s boost wasn’t the only one deserving of credit. While sales of the transitioning Buick Regal and discontinued Chrysler 200 each fell by more than half; while the Nissan Altima, Hyundai Sonata, Kia Optima, Volkswagen Passat, and Subaru Legacy all reported double-digit percentage losses; while the Mazda 6 and Ford Fusion fell 17 percent and 8 percent respectively; while Honda Accord sales were flat; Chevrolet Malibu sales skyrocketed.

Shot through the roof.

Exploded.

Leapt over tall buildings.

The Malibu was America’s third-best-selling midsize car in August 2017, strengthened by a 36-percent year-over-year improvement.

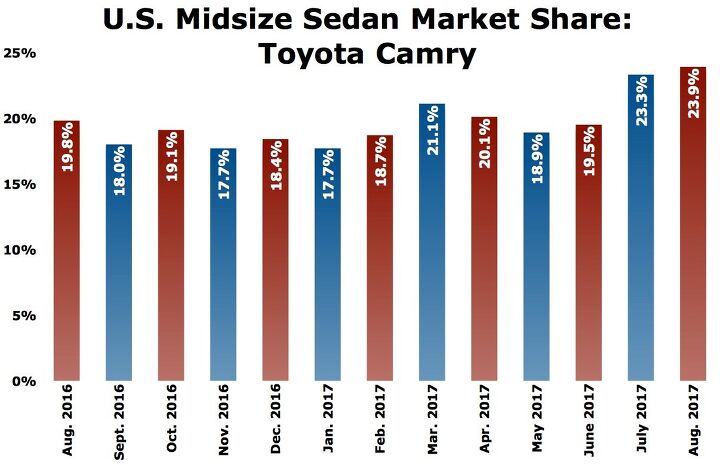

But it is the Camry, blessed with clear-out pricing on the outgoing 2017 and the oft-discussed 2018 model, that did just what Toyota thought the Camry could do: make massive market share gains. Toyota owned 17 percent of America’s midsize segment in 2013, nearly 18 percent in 2014, a full 18 percent in 2015, and marginally more in 2016. Through 2017’s first-half, Camry market share rose to nearly 20 percent.

But in August 2017, with the new Camry beginning to punch a bigger hole, Toyota owned 24 percent of America’s midsize sedan segment, a frightening figure for smaller brands that are about to see an all-new 2018 Honda Accord attempt to re-exert its influence in a shrinking category.

Not only are midsize car sales falling, the prices automakers are charging for midsize cars are falling, as well. Year-over-year, midsize car transaction prices fell 1 percent in August 2017 to $24,782, according to Kelley Blue Book. Transaction prices across the industry rose 1 percent last month, KBB says. This poses a problem for automakers competing in narrow niches of the category, where the drop in demand is accompanied by decreased margins. Mazda, for instance, owned just 2.1 percent of America’s midsize segment in August 2017, down from 2.4 percent in August 2016.

Mazda, which says it has no plans for cutting any nameplates “right now,” was certainly not the only car to lose great swathes of market share to the fast-rising Toyota Camry in August. Combined market share of the Ford Fusion, Nissan Altima, Hyundai Sonata, Kia Optima, Volkswagen Passat, and Subaru Legacy plunged from 46 percent in August 2016 to 39 percent last month.

[Image: Toyota; Chart © The Truth About Cars]

Timothy Cain is a contributing analyst at The Truth About Cars and Autofocus.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Varezhka I have still yet to see a Malibu on the road that didn't have a rental sticker. So yeah, GM probably lost money on every one they sold but kept it to boost their CAFE numbers.I'm personally happy that I no longer have to dread being "upgraded" to a Maxima or a Malibu anymore. And thankfully Altima is also on its way out.

- Tassos Under incompetent, affirmative action hire Mary Barra, GM has been shooting itself in the foot on a daily basis.Whether the Malibu cancellation has been one of these shootings is NOT obvious at all.GM should be run as a PROFITABLE BUSINESS and NOT as an outfit that satisfies everybody and his mother in law's pet preferences.IF the Malibu was UNPROFITABLE, it SHOULD be canceled.More generally, if its SEGMENT is Unprofitable, and HALF the makers cancel their midsize sedans, not only will it lead to the SURVIVAL OF THE FITTEST ones, but the survivors will obviously be more profitable if the LOSERS were kept being produced and the SMALL PIE of midsize sedans would yield slim pickings for every participant.SO NO, I APPROVE of the demise of the unprofitable Malibu, and hope Nissan does the same to the Altima, Hyundai with the SOnata, Mazda with the Mazda 6, and as many others as it takes to make the REMAINING players, like the Excellent, sporty Accord and the Bulletproof Reliable, cheap to maintain CAMRY, more profitable and affordable.

- GregLocock Car companies can only really sell cars that people who are new car buyers will pay a profitable price for. As it turns out fewer and fewer new car buyers want sedans. Large sedans can be nice to drive, certainly, but the number of new car buyers (the only ones that matter in this discussion) are prepared to sacrifice steering and handling for more obvious things like passenger and cargo space, or even some attempt at off roading. We know US new car buyers don't really care about handling because they fell for FWD in large cars.

- Slavuta Why is everybody sweating? Like sedans? - go buy one. Better - 2. Let CRV/RAV rust on the dealer lot. I have 3 sedans on the driveway. My neighbor - 2. Neighbors on each of our other side - 8 SUVs.

- Theflyersfan With sedans, especially, I wonder how many of those sales are to rental fleets. With the exception of the Civic and Accord, there are still rows of sedans mixed in with the RAV4s at every airport rental lot. I doubt the breakdown in sales is publicly published, so who knows... GM isn't out of the sedan business - Cadillac exists and I can't believe I'm typing this but they are actually decent - and I think they are making a huge mistake, especially if there's an extended oil price hike (cough...Iran...cough) and people want smaller and hybrids. But if one is only tied to the quarterly shareholder reports and not trends and the big picture, bad decisions like this get made.

Comments

Join the conversation

With the end of the J-series V6, the Camry XSE may well replace my Accord Touring. My mother was a Volvo fanatic before she was royally screwed by them. In that time, I grew up driving enough Volvo 240s, S70 GLTs and T-5s and S60 T-5s to be simultaneously familiar, yet completely disinterested in turbos, turbo lag, and the attendant complexities and idiosyncrasies that accompany them. My first car was a 1993 Camry V6 XLE handed down from my parents, so I suppose it'll be a long-awaited homecoming.

Chrysler is probably the only major carmaker in the world without a midsize car in its lineup. No wonder they are ranked at the back of the pack. Chrysler sucks............