Industry: Optimism Is Back, But Only A Little At A Time

Optimism sure ain’t what it used to be. Introducing its latest survey of auto industry executives [ PDF], Booz & Co. proclaims that “optimism is skyrocketing,” and that “a new wave of optimism is overtaking the U.S. auto industry.” They’re not wrong, but for those used to the pre-bailout days of unabashed optimism dressed up as analysis, the “new optimism” is remarkably guarded. And it’s all relative to the pessimism that was beginning to set in when the industry began to realize that the “old optimism” was wildly at odds with the slow-motion market recovery.

So, just how optimistic is the “new optimism”? Which companies have the most reason for optimism? What do industry executives worry about most? When do they expect a Chinese invasion? The answers to these questions and more after the jump.

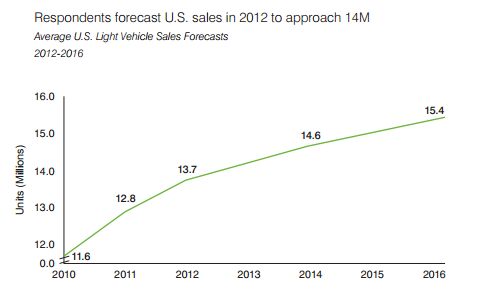

The “somewhat better” scenario that industry execs tell Booz is defining their business planning looks something like this graph. Overall, 86% of suppliers and OEMs expect auto sales growth to be consistent with GDP growth. This steady market growth outlook puts a premium on market share growth, and the execs polled certainly seem to have strong opinions on that front:

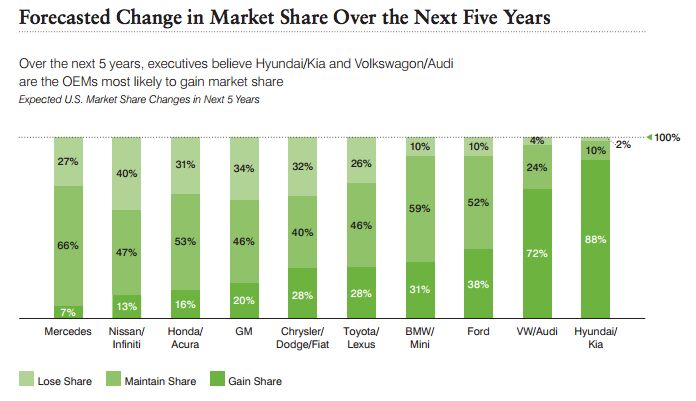

This chart is amazing to me. Clearly the US industry is terrified of two automakers: VW/Audi and Hyundai/Kia. More executives think VW will gain share than think Nissan, Honda, GM or Chrysler will gain or maintain their market share, and the optimism around Hyundai/Kia is straight-up out of control. It’s almost as if auto execs are haunted in their sleep every night by hipster hamsters and the disembodied voice of Jeff Bridges repeating the words “forty miles per gallon” over and over in a congenially bemused voice.

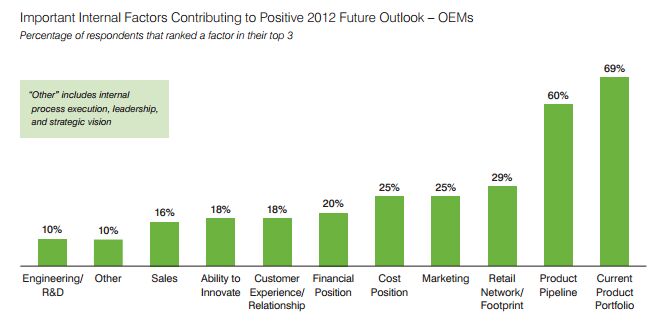

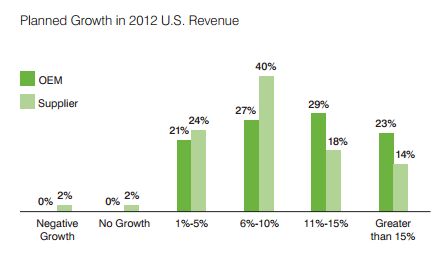

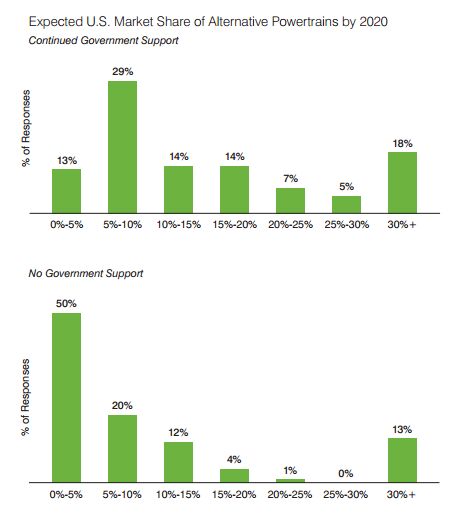

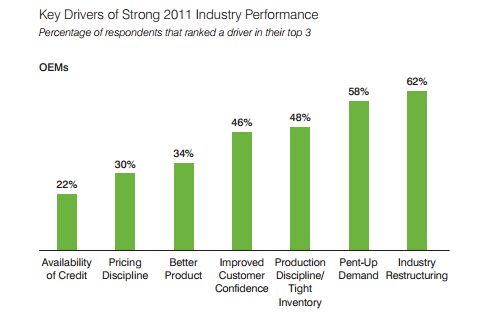

And where do executives think success comes from? Product, product, product. After all, market growth may be slow, but companies expect their revenue to rise. Cost, inventory and pricing discipline can deliver improved profit in a low sales growth environment, but only if the product sells itself.

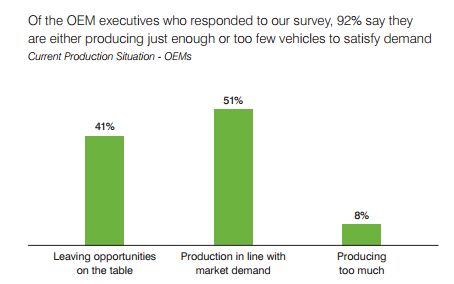

Meanwhile, 55% of the OEM executives polled say their companies are “capacity constrained” and 36% say they are comfortable with current capacity. As sales rise slowly, higher capacity utilization will help drive the revenue improvements the industry sees. Once again, as long as the product is good and discipline can be maintained.

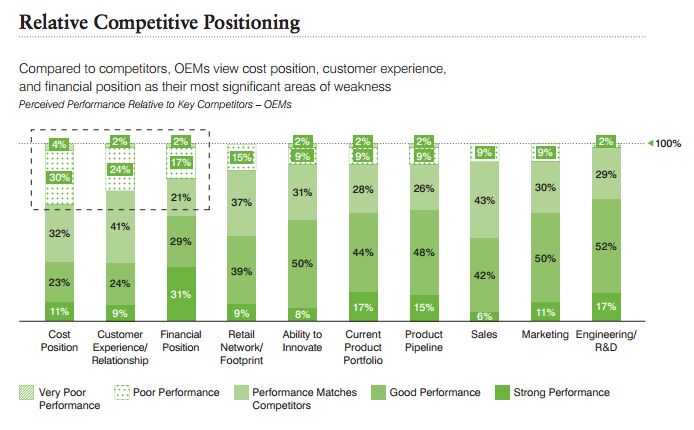

And though 69% identified current product portfolio as a top-three driver of growth in 2012, only 17% expect their current portfolio to turn in a “strong performance” vis-a-vis the competition, with 44% expecting a “good performance.” Cost position and financial position are two factors that could always be better from an executive’s position, but the fact that 26% of execs say customer experience and relationship performance could be “poor” or “very poor” is worrying.

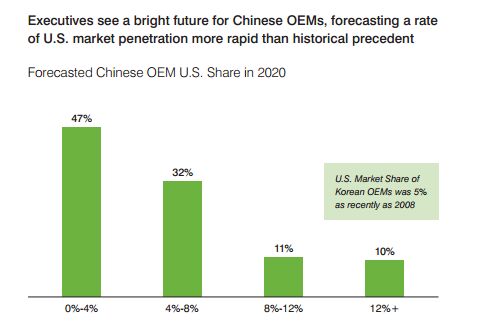

Meanwhile, all the talk of price and capacity discipline and improving profit rather than buying market share will only last as long as there’s no major effort to break into the US market. But by 2020, 32% of auto execs expect Chinese manufacturers to have broken into between four and eight percent of the market. By attacking the low end of the market and aggressively trying to buy a foothold in the US market, Chinese firms hold the potential to wreck the disciplined, realistic “new optimism” by putting severe pressure on pricing discipline.

For now, though, the automakers in the US market seems to be settling into a quiet phase of profit-taking rather than adventurous market share grabs. Clearly there’s a sense of having learned tough lessons from the auto bailout, and from the ongoing capacity issues in Europe. But rather than focusing on bailout-era lessons as they did last year, Booz’s 2012-specific questions now center on dealing with “black swan” events like last year’s tsunami and Thai floods. All of which adds to the overall perception that automakers are playing defense, concentrating on profits and hedging against uncertainty.

According to Booz & Co.: Two hundred and eight automotive executives from more than 75 automotive vehicle manufacturers and suppliers participated in the online survey. Thirty-two percent of the respondents were employees of OEMs, and 68 percent work for auto parts suppliers. Three-quarters of the executives were from U.S.-based firms. More than 50 percent of respondents were VP level or above.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kmars2009 I rented one last fall while visiting Ohio. Not a bad car...but not a great car either. I think it needs a new version. But CUVs are King... unfortunately!

- Ajla Remember when Cadillac introduced an entirely new V8 and proceeded to install it in only 800 cars before cancelling everything?

- Bouzouki Cadillac (aka GM!!) made so many mistakes over the past 40 years, right up to today, one could make a MBA course of it. Others have alluded to them, there is not enough room for me to recite them in a flowing, cohesive manner.Cadillac today is literally a tarted-up Chevrolet. They are nice cars, and the "aura" of the Cadillac name still works on several (mostly female) consumers who are not car enthusiasts.The CT4 and CT5 offer superlative ride and handling, and even performance--but, it is wrapped in sheet metal that (at least I think) looks awful, with (still) sub-par interiors. They are niche cars. They are the last gasp of the Alpha platform--which I have been told by people close to it, was meant to be a Pontiac "BMW 3-series". The bankruptcy killed Pontiac, but the Alpha had been mostly engineered, so it was "Cadillac-ized" with the new "edgy" CTS styling.Most Cadillacs sold are crossovers. The most profitable "Cadillac" is the Escalade (note that GM never jack up the name on THAT!).The question posed here is rather irrelevant. NO ONE has "a blank check", because GM (any company or corporation) does not have bottomless resources.Better styling, and superlative "performance" (by that, I mean being among the best in noise, harshness, handling, performance, reliablity, quality) would cost a lot of money.Post-bankruptcy GM actually tried. No one here mentioned GM's effort to do just that: the "Omega" platform, aka CT6.The (horribly misnamed) CT6 was actually a credible Mercedes/Lexus competitor. I'm sure it cost GM a fortune to develop (the platform was unique, not shared with any other car. The top-of-the-line ORIGINAL Blackwing V8 was also unique, expensive, and ultimately...very few were sold. All of this is a LOT of money).I used to know the sales numbers, and my sense was the CT6 sold about HALF the units GM projected. More importantly, it sold about half to two thirds the volume of the S-Class (which cost a lot more in 201x)Many of your fixed cost are predicated on volume. One way to improve your business case (if the right people want to get the Green Light) is to inflate your projected volumes. This lowers the unit cost for seats, mufflers, control arms, etc, and makes the vehicle more profitable--on paper.Suppliers tool up to make the number of parts the carmaker projects. However, if the volume is less than expected, the automaker has to make up the difference.So, unfortunately, not only was the CT6 an expensive car to build, but Cadillac's weak "brand equity" limited how much GM could charge (and these were still pricey cars in 2016-18, a "base" car was ).Other than the name, the "Omega" could have marked the starting point for Cadillac to once again be the standard of the world. Other than the awful name (Fleetwood, Elegante, Paramount, even ParAMOUR would be better), and offering the basest car with a FOUR cylinder turbo on the base car (incredibly moronic!), it was very good car and a CREDIBLE Mercedes S-Class/Lexus LS400 alternative. While I cannot know if the novel aluminum body was worth the cost (very expensive and complex to build), the bragging rights were legit--a LARGE car that was lighter, but had good body rigidity. No surprise, the interior was not the best, but the gap with the big boys was as close as GM has done in the luxury sphere.Mary Barra decided that profits today and tomorrow were more important than gambling on profits in 2025 and later. Having sunk a TON of money, and even done a mid-cycle enhancement, complete with the new Blackwing engine (which copied BMW with the twin turbos nestled in the "V"!), in fall 2018 GM announced it was discontinuing the car, and closing the assembly plant it was built in. (And so you know, building different platforms on the same line is very challenging and considerably less efficient in terms of capital and labor costs than the same platform, or better yet, the same model).So now, GM is anticipating that, as the car market "goes electric" (if you can call it that--more like the Federal Government and EU and even China PUSHING electric cars), they can make electric Cadillacs that are "prestige". The Cadillac Celestique is the opening salvo--$340,000. We will see how it works out.

- Lynn Joiner Lynn JoinerJust put 2,000 miles on a Chevy Malibu rental from Budget, touring around AZ, UT, CO for a month. Ran fine, no problems at all, little 1.7L 4-cylinder just sipped fuel, and the trunk held our large suitcases easily. Yeah, I hated looking up at all the huge FWD trucks blowing by, but the Malibu easily kept up on the 80 mph Interstate in Utah. I expect a new one would be about a third the cost of the big guys. It won't tow your horse trailer, but it'll get you to the store. Why kill it?

- Lynn Joiner Just put 2,000 miles on a Chevy Malibu rental from Budget, touring around AZ, UT, CO for a month. Ran fine, no problems at all, little 1.7L 4-cylinder just sipped fuel, and the trunk held our large suitcases easily. Yeah, I hated looking up at all the huge FWD trucks blowing by, but the Malibu easily kept up on the 80 mph Interstate in Utah. I expect a new one would be about a third the cost of the big guys. It won't tow your horse trailer, but it'll get you to the store. Why kill it?

Comments

Join the conversation

"For now, though, the automakers in the US market seems to be settling into a quiet phase of profit-taking rather than adventurous market share grabs." I would say that depends upon the automaker. VAG and Hyundai are both playing for share -- they are adding models and variety to their US lineups and they can use foreign operations to pay for it. If anything, Hyundai's problem appears to be one of having too little capacity. Likewise, Chrysler is also pushing for share. (They have no choice, as they risk not having sufficient to go the distance.) Nissan seems to be content with competing on price, leaving the top of the segments to the stronger competitors. Ford, TMC and Honda do seem to be more focused on margins. That's been a recipe for TMC's and Honda's success in the US, and Ford wants to play the same game. GM may be somewhere in the middle.

I think Hyundai is both pushing for share and focused on margins. During the the past 2 years or so they've added significant market share and and are among the lowest in incentives paid per unit. They've actually taken a page out of the Honda playbook—aggressively focusing on leasing.